Recognizing VA Home Loans: A Comprehensive Overview for Military Families

Recognizing VA Home Loans: A Comprehensive Overview for Military Families

Blog Article

Maximizing the Benefits of Home Loans: A Detailed Strategy to Protecting Your Perfect Building

Browsing the complicated landscape of mortgage calls for a methodical technique to make certain that you protect the home that straightens with your financial goals. By beginning with a detailed analysis of your economic placement, you can recognize one of the most ideal car loan options offered to you. Comprehending the nuances of different lending kinds and preparing a careful application can significantly affect your success. The details do not finish there; the closing process demands equal interest to information. To genuinely take full advantage of the advantages of mortgage, one have to consider what steps follow this foundational job.

Comprehending Home Finance Basics

Comprehending the fundamentals of home fundings is necessary for anyone thinking about buying a building. A home mortgage, typically described as a home loan, is a monetary item that permits people to obtain money to purchase realty. The borrower agrees to pay back the car loan over a specified term, typically ranging from 15 to three decades, with rate of interest.

Key components of home mortgage consist of the principal amount, rate of interest, and repayment routines. The principal is the amount borrowed, while the rate of interest is the cost of loaning that amount, expressed as a percent. Rate of interest can be repaired, continuing to be continuous throughout the car loan term, or variable, varying based on market problems.

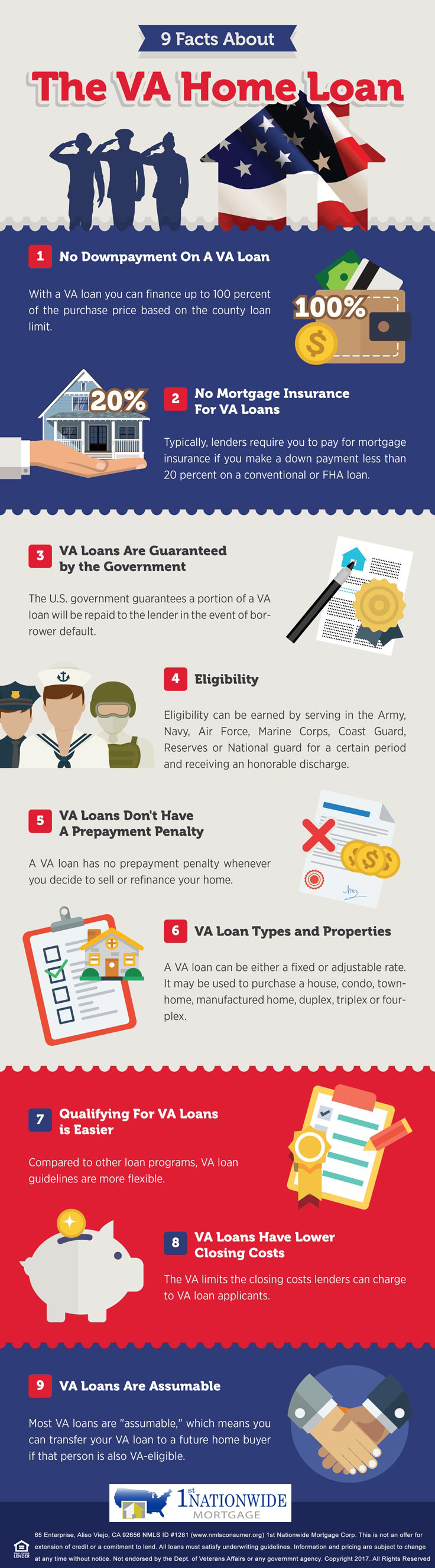

Additionally, debtors should be conscious of various sorts of home financings, such as conventional financings, FHA financings, and VA lendings, each with distinct qualification requirements and benefits. Understanding terms such as down settlement, loan-to-value ratio, and private home mortgage insurance (PMI) is likewise critical for making informed choices. By realizing these fundamentals, potential house owners can navigate the intricacies of the mortgage market and recognize options that line up with their economic objectives and residential property goals.

Assessing Your Financial Circumstance

Assessing your financial situation is a vital step prior to embarking on the home-buying journey. Next, listing all monthly expenses, guaranteeing to account for fixed prices like rental fee, energies, and variable expenses such as grocery stores and enjoyment.

After establishing your earnings and costs, identify your debt-to-income (DTI) ratio, which is important for lending institutions. This proportion is determined by splitting your overall monthly financial obligation payments by your gross month-to-month earnings. A DTI ratio below 36% is typically thought about beneficial, suggesting that you are not over-leveraged.

In addition, evaluate your credit report, as it plays an essential function in safeguarding positive funding terms. A greater credit report can lead to lower rate of interest prices, eventually conserving you cash over the life of the funding.

Discovering Loan Choices

With a clear image of your economic scenario developed, the next action involves checking out the different car loan options readily available to potential home owners. Understanding the different kinds of home car loans is important in picking the appropriate one for your needs.

Standard lendings are conventional funding techniques that generally require a higher credit report and down settlement however deal competitive rate of interest. Conversely, government-backed loans, such as FHA, VA, and USDA financings, provide to specific teams and commonly require reduced down settlements and credit report, making them easily accessible for new purchasers or those with restricted monetary sources.

One more option is adjustable-rate home loans (ARMs), which feature reduced first rates that readjust after a specific period, possibly resulting in considerable cost savings. Fixed-rate mortgages, on the various other hand, supply security with a consistent rates of interest throughout the finance term, guarding you against market changes.

In addition, consider the finance term, which usually varies from 15 to three decades. Much shorter terms may have higher monthly repayments however can save you interest with time. By very carefully reviewing these options, you can make an enlightened choice that lines up with recommended you read your financial goals and homeownership ambitions.

Getting Ready For the Application

Successfully planning for the application process is necessary for securing a mortgage. This stage prepares for obtaining beneficial financing terms and guarantees a smoother approval experience. Begin by examining your financial circumstance, that includes reviewing your debt score, income, and existing financial debt. A strong credit rating is vital, as it influences the loan amount and rates of interest offered to you.

Organizing these documents in breakthrough can substantially speed up the application process. This not just gives a clear understanding go to website of your borrowing capacity yet additionally reinforces your position when making an offer on a property.

In addition, determine your budget plan by factoring in not simply the lending quantity yet additionally real estate tax, insurance policy, and upkeep prices. Lastly, acquaint yourself with different financing types and their respective terms, as this expertise will empower you to make informed choices throughout the application process. By taking these proactive actions, you will certainly enhance your preparedness and enhance your chances of protecting the home loan that ideal fits your demands.

Closing the Offer

Throughout the closing conference, you will examine and sign numerous records, such as the financing quote, closing disclosure, and home loan agreement. It is vital to thoroughly understand these records, as they lay out the finance terms, repayment schedule, and closing expenses. Make the effort to ask your lending institution or actual estate representative any kind of concerns you may need to prevent misconceptions.

As soon as all records are authorized and funds are moved, you will get the tricks to your new home. Bear in mind, closing costs can vary, so be gotten ready for costs that might consist of evaluation costs, title insurance, and attorney charges - VA Home Loans. By remaining organized and informed throughout this process, you can guarantee a smooth shift into homeownership, making the most of the advantages of your home mortgage

Final Thought

Finally, maximizing the benefits of mortgage necessitates a systematic method, encompassing a complete analysis of financial situations, expedition of varied car loan alternatives, and precise preparation for the application process. By adhering to these actions, potential home owners can enhance their chances of safeguarding favorable funding and accomplishing their building ownership goals. Eventually, cautious navigation of the closing process additionally strengthens a successful shift into homeownership, guaranteeing long-lasting financial security and satisfaction.

Browsing the facility landscape of home car loans calls for a systematic approach to ensure that you secure the residential or commercial property that aligns with your financial objectives.Recognizing the basics of home financings is essential for any person taking into consideration buying a property - VA Home Loans. A home lending, often referred to as a home mortgage, is a financial product that enables individuals to borrow money to purchase actual estate.In addition, debtors need to be aware of various types of home finances, such as VA Home Loans conventional loans, FHA finances, and VA fundings, each with distinctive eligibility standards and benefits.In verdict, maximizing the advantages of home car loans necessitates a methodical strategy, including an extensive analysis of monetary scenarios, exploration of varied car loan alternatives, and precise prep work for the application process

Report this page